- Compliance Office, OnFinance AI

- Posts

- Agentic AI Control Layer for Indian BFSI Cybersecurity & Compliance

Agentic AI Control Layer for Indian BFSI Cybersecurity & Compliance

OnFinance AI agents suite turns cybersecurity & compliance into a competitive edge for Banks, AMCs, NBFCs, and Exchanges.

Cybersecurity & Data-Protection AI Agents for India’s BFSI

🔑 Why This Matters

Tighter rules – RBI’s Master Direction on IT Outsourcing, SEBI’s CSRF & Cloud Frameworks, CERT-In’s 6-hour breach rule, and the DPDP Act 2023 have raised the bar.

Bigger attack-surface – API banking, cloud migrations, and hybrid work mean more entry points.

Board-level stakes – Penalties, licence risk, and reputational damage sit squarely with CXOs and directors.

AI agents now offer the only scalable, 24×7 way to monitor controls, surface gaps, and generate regulator-ready evidence.

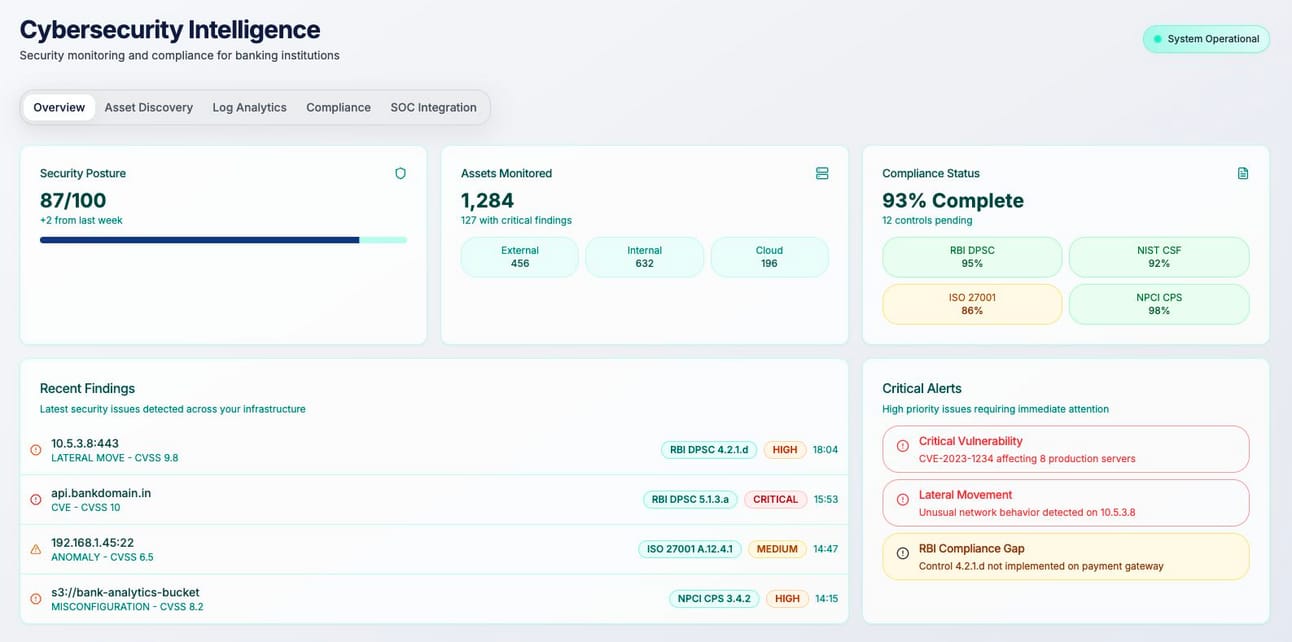

Cybersecurity Intelligence AI

🛡️ OnFinance AI – Cybersecurity & Data-Protection Suite

AI Agent | Primary Use Case | Regulator | Key Category | Regulation Alignment (snapshot) |

|---|---|---|---|---|

Compliance Data Privacy AI | Enforce DPDP-compliant data handling, consent, purpose limitation | DPDP Act & SEBI | Data-Privacy Compliance | Maps data flows ➜ flags non-compliant processing ➜ generates RoPA & DPIA logs |

CIRF Cybersecurity Framework AI | Score controls vs SEBI Cyber Security & Resilience Framework (CSRF) | SEBI | Cybersecurity Compliance | Auto-checks 40+ CSRF controls incl. incident response & periodic audits |

IT Outsourcing Compliance AI | Track all IT & vendor contracts for RBI approvals & clauses | RBI | Outsourcing Risk | Aligns with RBI Master Direction (Apr 2023) – due-diligence, data-access |

Cloud Compliance AI | Assess cloud posture, encryption, & localisation vs SEBI Cloud Framework | SEBI | IT Risk (Cloud) | Tests 120+ controls incl. KMS, IAM, cross-border data restrictions |

Data Localization Compliance AI | Verify payments & customer data stay on Indian soil | RBI | Data Localization | Automates storage-location checks; flags foreign S3/BLOB buckets |

Cyber Incident Compliance AI | Detect incidents & auto-triage breach-report workflows (2-6 hr) | RBI & SEBI | Cyber-Incident Response | Pre-filled CERT-In / RBI / SEBI forms; live countdown until submission SLA |

BCP / Resilience Compliance AI | Evaluate BCP, DR drills, RTO/RPO vs RBI & SEBI norms | RBI & SEBI | Operational Resilience | Monitors drill evidence, fail-over tests, third-party dependencies |

Audit Trail Compliance AI | Ensure tamper-proof logs for trades, configs, and system actions | SEBI | Systems-Audit Controls | Built-in WORM storage tests, SHA-256 hash verification |

Data Disposal Compliance AI | Automate deletion of expired data & log proof for auditors | DPDP Act & RBI | Data-Lifecycle Mgmt. | Triggers deletion jobs; exports signed disposal certificates |

Customer Consent Compliance AI | Capture & reconcile granular consents (e.g., digi-lending) | RBI & SEBI | Consent Management | Real-time consent ledger; highlights missing or stale approvals |

All agents deploy on-prem or private cloud, stream data via REST / Kafka, and feed a shared Explainability Layer for instant audit trails.

🚀 90-Day Impact Snapshot

Metric | Pre-AI | Post OnFinance AI |

|---|---|---|

Manual policy checks | 200+ hrs / qtr | <10 hrs / qtr |

Breach-report prep time | 6-8 hrs | <45 min |

Cloud mis-config alerts closed | 61 % | 98 % |

Regulator audit findings | 7 (avg) | 0 |

(Aggregated across 5 BFSI clients in FY 2024-25)

🧩 How It Fits Into Your Stack

Ingest – SIEM logs, cloud APIs, vendor registers, consent DBs

Analyse – LLM-powered policy engine maps controls ↔ clause library

Alert & Orchestrate – Jira / ServiceNow / mail-based workflows

Evidence – One-click generation of RBI / SEBI / CERT-In artefacts

No rip-and-replace. Typical go-live: <4 weeks.

📈 The Road Ahead

Predictive resilience scoring for board dashboards

Continuous controls monitoring with GenAI-generated remediation steps

Cross-jurisdiction modules (MAS, DIFC) rolling out Q4 2025

Ready to Bullet-Proof Your Cyber Posture?

📧 Write to: [email protected]

📱 Call/WhatsApp: +91 72330 89282

🌐 Website: onfinance.ai

🏢 Company: OnFinance AI | Mumbai, India